Last week we summarized the briefs submitted by petitioner New Prime Inc. and respondent Dominic Oliveira in New Prime Inc. v. Oliveira, as well as the briefs submitted by amici curiae for New Prime. Today we examine the briefs submitted by amicus curiae for Oliveira.

Amicus Briefs for Oliveira

The American Association for Justice explains that when the American Federation of Labor (AFL) successfully lobbied for the Section 1 exemption to the FAA in 1925, the membership of the AFL-affiliated Teamsters included a substantial number of drivers who were independent contractors. The AFL would not have pushed for an exemption that excluded a significant part of its membership in the transportation industry. Moreover, the AFL lobbied for the exemption because it recognized early on that individual arbitration unfairly rewards employers over workers. Employers gain favor with arbitrators as “repeat players,” and employees are resistant to bring individual, small-value claims.

The Constitutional Accountability Center asserts that when Congress enacted the FAA, “employment” was a general term for the performance of work not limited to master-servant relationships. While independent contractors were understood not to be employees in 1925, the more limited scope of the word “employee” only came to restrict the meaning of the term “employment” over time and not until well after the FAA’s enactment.

A group of employment law scholars explain that many federal and state statutes and regulations do not distinguish between workers on the basis of the common law concepts of employees and independent contractors. Laws that do use the common-law distinction require an inquiry into the actual relationship between the company and the worker, rather than relying reflexively on the label in a contract. The FAA’s exemption for “contracts of employment” in the transportation industry is consistent with the statutory and regulatory regimes that do not draw lines between workers using common-law precepts. Even if the Court decides Section 1 contains such a distinction, it should find that the FAA commands study of the real economic relationship between the parties to the contract.

A group of labor and legal historians recount how Congress enacted the Section 1 exemption to preserve established statutory dispute resolution mechanisms for “seamen” under the 1872 Shipping Commissioners Act and for “railroad employees” under Title III of the 1920 Transportation Act. Neither statute’s dispute resolution scheme depended on whether the worker was an employee or independent contractor. Applying ejusdem generis, “any other class of workers” in the exemption should thus be read to cover all types of transportation workers, not just common-law employees.

A group of statutory construction scholars argue that New Prime’s asserted construction of the Section 1 exemption is flawed on several grounds. First, New Prime relies on a 2014 dictionary definition for “employment contract” restricted to agreements between employers and employees, but that dictionary indicates that the earliest known usage of the phrase was 1927, two years after the FAA was passed. Moreover, the 1910 and 1933 of that dictionary did not have entries for the phrase, indicating that in 1925 it had no technical meaning. The appellate court correctly relied on contemporaneous definitions of “employment” as “an act of employing” and the verb “employ” as “to make use of the services of . . .” to read “contracts of employment” broadly. Canons of construction also support a definition inclusive of both employees and contractors. The common thread between “seamen” and “railroad employees” in 1925 was that they worked in the transportation industry, not that they were employees. Consequently, noscitur a sociis and ejusdem generis counsel that “any other class of workers” refers to transportation workers generally. Ejusdem generis should not be used to interpret “contracts of employment” because it precedes rather than follows a particularized list. Finally, reading “contracts of employment” broadly does not extinguish the phrase’s textual distinction from “contracts evidencing a transaction involving commerce” in Section 2 because they maintain independent operative meanings.

Massachusetts, thirteen other states, and Washington, D.C. stress the significance of the phrase “class of workers.” For one, federal agencies have long used the term to refer to categories of workers by income source, including employees receiving an hourly wage, employees earning a salary, and contractors making their own income. “Any other class of workers” in Section 1 thus encompasses each of these different classes. Moreover, if Congress wanted “contracts of employment” to be limited to common-law employment agreements, they would have used “employees” instead of “workers” in Section 1’s residual clause. Amici also draw attention to the 1935 Motor Carrier Act, which provided a dispute resolution mechanism for an interstate trucking workforce mostly composed of independent contractors. The Motor Carrier Act was one of the statutes that Congress anticipated adopting when it exempted transportation workers from the FAA, which suggests that independent contractor agreements were meant to be included in the exemption.

The Owner-Operator Independent Drivers Association explains how the lease agreements between trucking companies and truck drivers who are independent contractors are “contracts of employment.” Congress crafted the Section 1 exemption so it could adopt dispute resolution mechanisms specific to the transportation industry. Congress then authorized the Interstate Commerce Commission (ICC) to resolve disputes between trucking companies and independent drivers. Once the ICC was terminated in 1995, Congress gave independent drivers a private right of action to adjudicate their claims, indicating it wanted these drivers to be able to pursue their rights in court.

Public Citizen argues that the FAA cannot be invoked to compel arbitration of a dispute over arbitrability if the Act is not applicable. While New Prime asserts that arbitration agreements are “severable” from the contracts that contain them, meaning that an arbitration provision can be enforced even if the contract as a whole is invalid, the severability principle only applies to challenges to the validity of an arbitration clause, not to whether the FAA applies in the first place.

Senator Sheldon Whitehouse of Rhode Island writes to decry the Supreme Court majority’s emerging policy preference for denying citizens their right to a civil jury through its recent FAA decisions. The rulings reflect a pro-corporate bias that threatens the Court’s reputation as a neutral arbiter. The instant case’s path to the Court is especially troubling because no conflict currently exists among the appellate circuits over the case’s central question, leaving citizens with the impression that the Court only took up the case to satisfy corporate interests. While the case should not have been granted in the first place, the Court should now recognize that the plain language of the Section 1 exemption for the contracts of transportation workers encompasses independent contractor agreements.

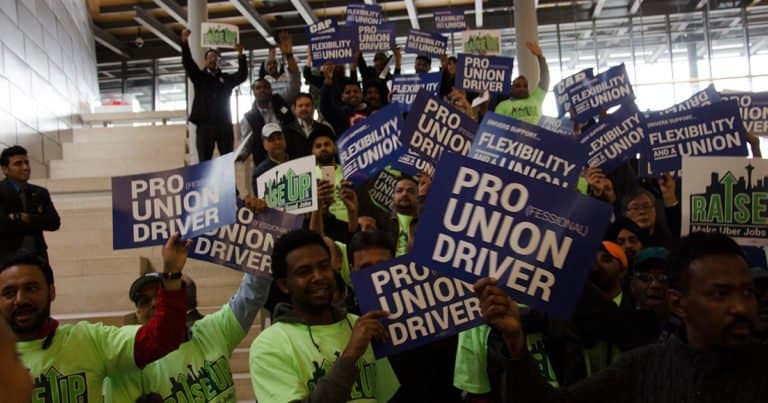

Sociologist Steve Viscelli, the Wage Justice Center, REAL Women in Trucking, and a group of current and former owner-operator and lease-operator truck drivers shine light on the realities of New Prime’s “lease-operator” model under which drivers are often misclassified as independent contractors. Drivers under this model often end up working more than forty hours per week while still owing money to their employer by week’s end. The Court should read “contracts of employment” in the FAA’s Section 1 exemption to encompass these arrangements because the workers are definitionally employees.

The Teamsters, the National Employment Law Project, the Economic Policy Institute, and the National Employment Lawyers Association detail how independent contractor misclassification is particularly rampant in the trucking industry. By misclassifying trucking employees as contractors, bad actor employers seeking to avoid tax and other liability deprive the public of revenue, undercut law-abiding employers in the marketplace, and deprive workers of income and protections on the job. Amici argue that the Court need not determine whether Oliveira was misclassified because the plain text of “contracts of employment” encompasses the work agreements of both employees and contractors. However, if the Court reads the phrase restrictively, it must inquire into the actual relationship of the parties to the contract given the misclassification endemic in the industry.

Daily News & Commentary

Start your day with our roundup of the latest labor developments. See all

December 13

In today’s News & Commentary, the Senate cleared the way for the GOP to take control of the NLRB next year, and the NLRB classifies “Love is Blind” TV contestants as employees. The Senate halted President Biden’s renomination of National Labor Relations Board Chair Lauren McFerran on Wednesday. McFerran’s nomination failed 49-50, with independents Joe […]

December 11

In today’s News and Commentary, Biden’s NLRB pick heads to Senate vote, DOL settles a farmworker lawsuit, and a federal judge blocks Albertsons-Kroger merger. Democrats have moved to expedite re-confirmation proceedings for NLRB Chair Lauren McFerran, which would grant her another five years on the Board. If the Democrats succeed in finding 50 Senate votes […]

December 10

In today’s News and Commentary, advocacy groups lay out demands for Lori Chavez-DeRemer at DOL, a German union leader calls for ending the country’s debt brake, Teamsters give Amazon a deadline to agree to bargaining dates, and graduates of coding bootcamps face a labor market reshaped by the rise of AI. Worker advocacy groups have […]

December 9

Teamsters file charges against Costco; a sanitation contractor is fined child labor law violations, and workers give VW an ultimatum ahead of the latest negotiation attempts

December 8

Massachusetts rideshare drivers prepare to unionize; Starbucks and Nestlé supply chains use child labor, report says.

December 6

In today’s news and commentary, DOL attempts to abolish subminimum wage for workers with disabilities, AFGE reaches remote work agreement with SSA, and George Washington University resident doctors vote to strike. This week, the Department of Labor proposed a rule to abolish the Fair Labor Standards Act’s Section 14(c) program, which allows employers to pay […]