Zachary Sorenson is a student at Harvard Law School and a member of the Labor and Employment Lab.

One year ago, weeks into Covid-induced lockdowns and with the trajectory of the pandemic unknown, Congress passed the CARES Act, a $2.2 trillion relief package providing aid to businesses, local governments, and individuals. For workers who lost jobs in the unprecedented unemployment crisis triggered by the pandemic, the most impactful piece of this legislation was its massive expansion in unemployment insurance (UI) benefits. Congress pulled out some of the normal tools it had used in previous recessions, authorizing additional weeks of benefits and increasing the federal cost share. But the CARES Act also included two new responses at a scale not tried before: (1) a program called Pandemic Unemployment Assistance (PUA) to provide benefits to workers not otherwise eligible for state UI, including independent, self-employed, and gig workers, and (2) an additional $600/week for all workers receiving any UI benefits.

In total, the federal government has now distributed more than $475 billion in unemployment relief, on top of the nearly $270 billion paid by states. While the crisis is certainly not yet over—unemployment rates are still almost double what they were last February—Congress should use the lessons from the pandemic to strengthen the unemployment insurance system moving forward.

Pandemic Unemployment Assistance

The most ambitious part of the CARES Act’s expansion was the PUA program. While Congress has in previous crises extended how long benefits last, PUA expanded the categories of workers covered by UI in the first place.

Normally, around 90% of the civilian labor force is covered by state UI, and that proportion has remained relatively flat over recent decades. Independent contractors and self-employed workers are not covered: UI protects employees who are terminated by their employer through no fault of their own, and that model doesn’t map well to workers who are truly independent and control their own work (UI coverage for workers like Uber and Lyft drivers who are misclassified by their employers as contractors is a separate challenge best addressed by ensuring that workers are properly classified in advance, and that their employers are paying into the UI system). However, the crash in certain sectors in March showed how bona fide independent workers, too, can lose work through no fault of their own as a result of severe economic conditions, even if they may have more autonomy than traditional employees on paper.

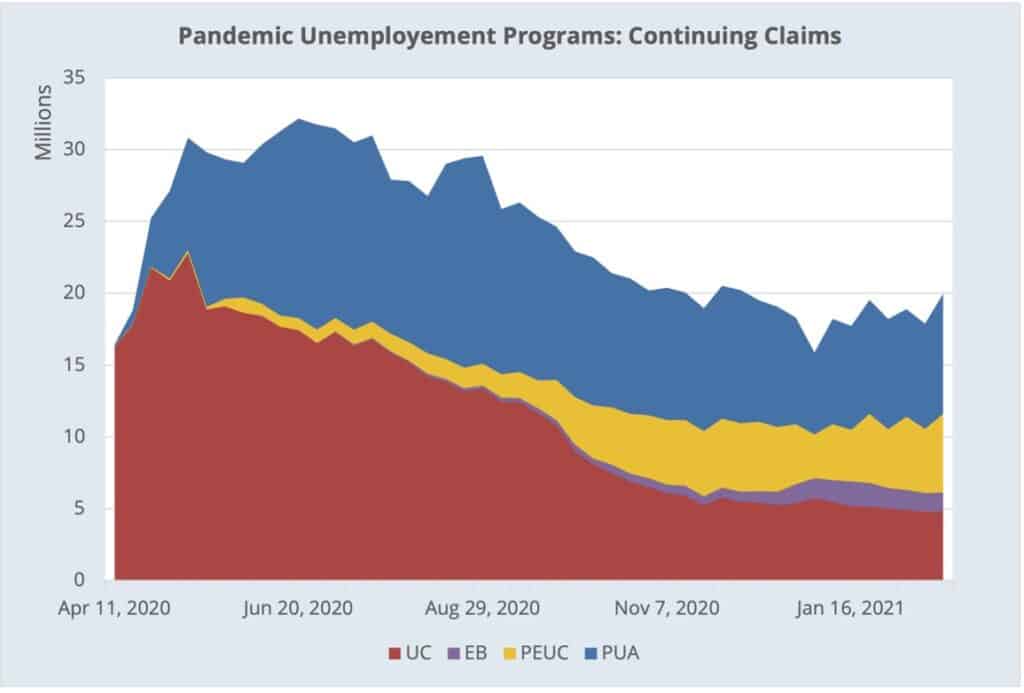

Recognizing that reality, PUA expanded coverage to the 10% of workers not covered, as well as those covered but not eligible for benefits (e.g., workers with insufficient work history or who quit voluntarily). This was a massive expansion and proved difficult for states to quickly implement. Especially at the start, backlogs were long for PUA claims, which required more manual review by states than regular claims. And as the widespread IT and implementation challenges highlight, no amount of relief matters if the benefits cannot be distributed in time.

Still, as the pandemic has continued, PUA has scaled up and now makes up the plurality of all UI claims. Having invested substantial resources in ramping up PUA, Congress and states should now look for ways to make aspects of the program more permanent. First, they should allow genuinely independent contractors to opt into UI coverage by paying premiums—and making the process easy and affordable. Gig companies could also be required to facilitate their (genuine) independent contractors’ ability to opt in by automating the payment process for contractors on their platforms who want UI coverage. Second, they should take advantage of declining claims to continue modernizing their systems, ensuring they are optimized for distributing benefits efficiently rather than introducing complexity in an attempt to minimize fraud at the expense of timeliness and accessibility.

Supplemental payments

The $600/week supplemental payments were another unprecedented expansion, temporarily transforming UI from a threadbare safety net to something almost more akin to universal basic income, at least for workers who had lost jobs.

State UI programs normally provide cash support for up to 26 weeks to eligible workers who lose their jobs. UI functions at two levels: for individual workers, it offers a temporary buffer of partial wage replacement to lessen the financial blow of job loss while they find another job; at an economy-wide scale, it is an automatic stabilizer that scales up during recessions as more workers lose jobs then tapers off as employment returns during recoveries. In response to the Great Recession, Congress went a step beyond these automatic effects, extending UI benefits by 53 weeks and providing an additional $25/week to all recipients.

The $600 payments went much further, attempting to close the gap between unemployment benefits and actual lost wages. By design, UI normally provides 50% wage replacement at most, and benefit caps—ranging from $190/week in Puerto Rico to $855/week in Massachusetts—mean the average benefit amount is actually only 34% of the average wage. The logic behind partial replacement is to provide benefits while maintaining an incentive to find work. During the pandemic, however, restrictions meant that many workers who lost jobs could not find replacements, whatever the incentives. More importantly, keeping workers home was crucial for both their individual safety as well as public health generally.

The supplemental payments succeeded in closing the gap: according to one study, total UI payments after the CARES Act replaced 134% of lost income for the median beneficiary, and more than 69% had their lost wages fully replaced. These expanded benefits, as well as the $1,200 payments sent to all eligible taxpayers, meant the poverty rate actually declined by 1.5% in the first three months of the pandemic, even as unemployment skyrocketed. Economists estimate that without these programs, the rate would have increased by 2.5%, and more than 7 million people would have been in poverty in June 2020. As an added benefit, providing flat payments to all beneficiaries rather than calculating full replacement benefit amounts individually (as was also considered) meant that states could provide payments more quickly.

Even a “normal” recession makes it much harder than normal for workers who lose jobs to find replacements. That’s why some economists have argued that optimal UI benefits should scale in proportion to the difficulty of finding a job, recognizing that incentives shift depending on the job market. Congress should enact this change, adopting short-term supplemental payments like the ones in the CARES Act a stabilizer that can kick in automatically, at least at a smaller scale, when unemployment crosses a certain threshold.

The Covid-19 pandemic was an unexpected and nearly instantaneous exogenous shock to the economy, and hopefully one not to be soon repeated. The next economic crisis will undoubtedly be different, but Congress and states can prepare now using the lessons learned over the past year. Indeed, that is what happened eighty years ago, when America’s unemployment insurance system was created in response to the devastation of the Great Depression. Today, in the aftermath of a similarly unprecedented crisis that has disrupted a labor force that looks very different from that of the 1930s, lawmakers should similarly harness the moment to ensure that workers are more thoroughly and adequately covered when the next economic crisis inevitably arrives.

Daily News & Commentary

Start your day with our roundup of the latest labor developments. See all

February 17

San Francisco teachers’ strike ends; EEOC releases new guidance on telework; NFL must litigate discrimination and retaliation claims.

February 16

BLS releases jobs data; ILO hosts conference on child labor.

February 15

The Office of Personnel Management directs federal agencies to terminate their collective bargaining agreements, and Indian farmworkers engage in a one-day strike to protest a trade deal with the United States.

February 13

Sex workers in Nevada fight to become the nation’s first to unionize; industry groups push NLRB to establish a more business-friendly test for independent contractor status; and UFCW launches an anti-AI price setting in grocery store campaign.

February 12

Teamsters sue UPS over buyout program; flight attendants and pilots call for leadership change at American Airlines; and Argentina considers major labor reforms despite forceful opposition.

February 11

Hollywood begins negotiations for a new labor agreement with writers and actors; the EEOC launches an investigation into Nike’s DEI programs and potential discrimination against white workers; and Mayor Mamdani circulates a memo regarding the city’s Economic Development Corporation.