Ryan is a student at Harvard Law School and a member of the Labor and Employment Lab.

Most of the leading Democratic candidates for President have argued for raising the federal minimum wage to $15.00 per hour to ensure that Americans working full-time can earn a living wage (as Pete Buttigieg, Amy Klobuchar, Bernie Sanders, and Elizabeth Warren have said). Moreover, all of these candidates have argued for indexing the federal minimum wage to median wage growth (as explained on the campaign websites for Buttigieg and Warren, and as seen in a recent bill proposed by Sanders and co-sponsored by Klobuchar and Warren) to ensure automatic increases over time without needing to expend political capital raising it, as lawmakers have had to do each of the 22 times they raised it before.

However, these proposals fall short. First, they lack an accounting of why the proposed minimum wage would amount to a living wage. In other words, why can a full-time worker earning $15.00 per hour support the average American household (the size of which is currently 2.52 persons)? Which household costs are included in that calculation? Do costs fluctuate depending on household location? Such an accounting is paramount given evidence like Rep. Katie Porter’s mathematical proof that $16.50 per hour was not nearly enough to support a family of two where she lives in Irvine, CA. Second, these proposals lack evidence of why indexing the minimum wage to median wage growth would keep up with what American workers actually need to live. Moreover, the proposals do not address why median wage growth is a better index than formulas in other recent bills that propose indexing the minimum wage to one of the Consumer Price Indexes (changes in which are commonly referred to as inflation) or formulas in countries that index their minimum wage to factors like Gross Domestic Product (“GDP”) (as with Brazil) or the poverty level (as with Malaysia). This post tackles those issues, arguing for indexing the federal minimum wage to an annually-updated, regionally-sensitive calculation of what American households actually need to live, thereby permanently ensuring that Americans working full-time can support their household with a living wage.

First, consider the need for an accounting of what American households need to live. At first blush, one might think that the federal poverty thresholds already do this. Not so. Neither the law establishing the federal poverty thresholds, the guidance supporting that law, nor the history of these thresholds connect the concepts of “earning a living wage” with “meeting the poverty thresholds.” On the contrary, the federal poverty thresholds estimate a cost of living based on an outdated, nationwide food budget and nothing else. To that end, starting in 1962, a U.S. Social Security Administration worker named Mollie Orshansky developed the framework for the federal poverty thresholds that we still use today. Orshansky used data from the U.S. Department of Agriculture (“USDA”) to estimate the average amount of money that households of different sizes spent on food; she did not incorporate other significant household expenditures (e.g., housing, medical and child care, transportation), taxes, and investments (e.g., saving for retirement). Then, Orshansky multiplied that number by three to account for USDA data from 1955 suggesting that families of three or more spent about one-third of their average net income on food; in 2020, food expenses account for about 11% of households’ budgets, not one-third. Finally, in 1969, the government adopted Orshansky’s numbers to define the federal poverty thresholds nationwide; it neglected regional differences (e.g., the cost of renting a home in Manhattan versus Milwaukee, different state and local tax obligations). The underlying formula has not changed since then, but the thresholds have been indexed to the Consumer Price Index and updated by the U.S. Department of Health and Human Services annually.

A federal minimum wage should be indexed to something akin to MIT’s Living Wage Calculator, which factors in most expenditures that households need to live, as well as regional differences. Moreover, as its User’s Guide/Technical Notes explain, MIT’s Living Wage Calculator contains several normative judgments (e.g., excluding investments and costs related to entertainment and leisure) that our elected representatives should make. The Fight for $15 may be a powerful marketing tool because it is easy to remember, but supporting a round number like $15.00 per hour without any accounting of how it was derived divests our elected representatives of political accountability for the normative judgments underlying how much money we should require employers to pay employees under federal law.

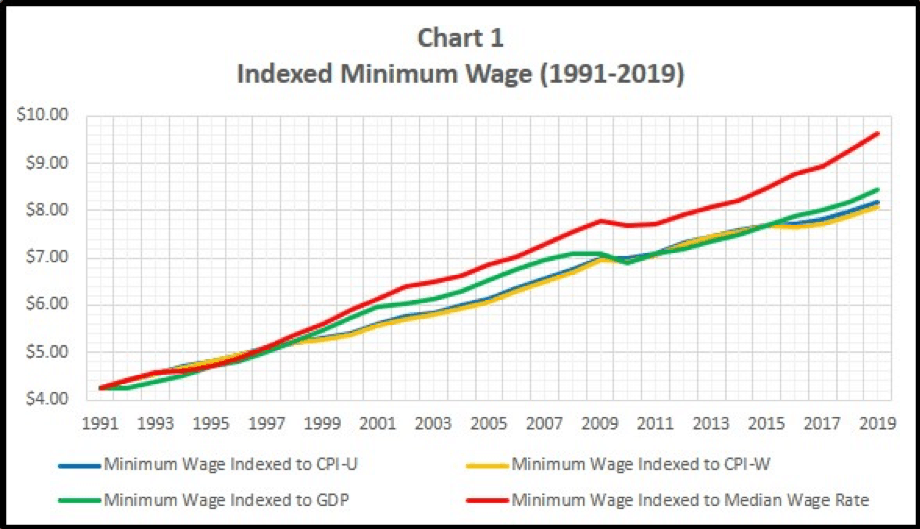

Second, consider indexing. None of the indexing proposals referenced above would keep the minimum wage on pace with what Americans need to live. Chart 1 tracks the growth of the 1991 minimum wage (i.e., $4.25 per hour) if it had been indexed to the Consumer Price Index for All Urban Consumers (“CPI-U”), the Consumer Price Index for Urban Wage Earners and Clerical Workers (“CPI-W”), GDP, or median wage growth. Chart 2 tracks the growth of the 2009 minimum wage (i.e., $7.25 per hour) if it had been indexed to the same factors. Depending on which factor you adopt, by 2019, the $4.25 per hour minimum wage from 1991 would have increased to between $8 and $10 per hour, and the $7.25 per hour minimum wage from 2009 would have increased to between $8 and $9 per hour. In other words, even if Congress had indexed the 1991 or 2009 minimum wages to commonly-accepted indicators of inflation (i.e., CPI-U or CPI-W), GDP, or median wage growth, there would still be a Fight for $15.

The failure of these indexes to track the cost of living is not surprising when you consider what they are meant to measure. A living wage is meant to measure how much households need to live, which includes consuming goods and services, paying taxes, and investing in the future. Yet, none of the indexes referenced above account for only consumption, taxes, and investments:

- The Consumer Price Indexes account for consumption costs, but not taxes or investments, making them incomplete indexes for keeping up with the actual cost of living.

- GDP generally measures a country’s productivity. It reflects not only consumption and investments, but also government spending and net exports; it does not directly measure taxes. As such, it can somewhat approximate the cost of living, but it is overinclusive as in that aim because it considers factors that do not directly relate to the cost of living (i.e., government spending and net exports), and it is underinclusive in that aim because it fails to directly reflect taxes.

- Median wages reflect only what employers are willing and able to pay workers based on a multitude of factors that can be entirely-untethered from how much those workers need to support their household. Furthermore, median wages can stagnate for political reasons like the “comprehensive, decadeslong anti-worker agenda” even when consumption costs increase.

Rather than indexing the federal minimum wage to any of these factors, American workers deserve a regionally-sensitive minimum wage that perpetually keeps pace with what is needed to live (i.e., annually updating an accounting of living wages akin to MIT’s Living Wage Calculator). By doing so, we can ensure that Americans working full-time permanently earn enough money to support their households.

Daily News & Commentary

Start your day with our roundup of the latest labor developments. See all

July 11

Regional director orders election without Board quorum; 9th Circuit pauses injunction on Executive Order; Driverless car legislation in Massachusetts

July 10

Wisconsin Supreme Court holds UW Health nurses are not covered by Wisconsin’s Labor Peace Act; a district judge denies the request to stay an injunction pending appeal; the NFLPA appeals an arbitration decision.

July 9

the Supreme Court allows Trump to proceed with mass firings; Secretary of Agriculture suggests Medicaid recipients replace deported migrant farmworkers; DHS ends TPS for Nicaragua and Honduras

July 8

In today’s news and commentary, Apple wins at the Fifth Circuit against the NLRB, Florida enacts a noncompete-friendly law, and complications with the No Tax on Tips in the Big Beautiful Bill. Apple won an appeal overturning a National Labor Relations Board (NLRB) decision that the company violated labor law by coercively questioning an employee […]

July 7

LA economy deals with fallout from ICE raids; a new appeal challenges the NCAA antitrust settlement; and the EPA places dissenting employees on leave.

July 6

Municipal workers in Philadelphia continue to strike; Zohran Mamdani collects union endorsements; UFCW grocery workers in California and Colorado reach tentative agreements.