Chinmay G. Pandit is the Digital Director of OnLabor and a student at Harvard Law School.

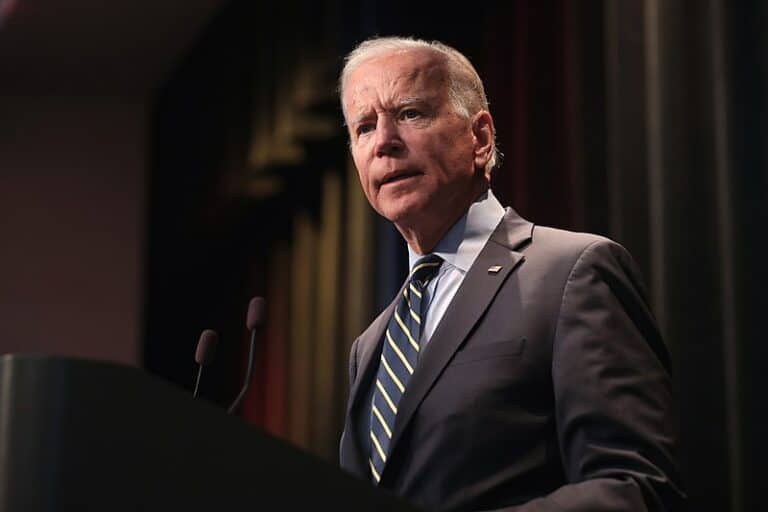

Public pension funds and other institutional investors rejoiced earlier this week after President Biden signed a landmark executive order directing federal agencies to conduct a comprehensive review of digital currencies, with the ultimate goal of building a clear, durable, and conducive regulatory framework for the roughly $2 trillion industry.

The executive order, which represents the first time that the White House has formally weighed in on cryptocurrency, instructed the Department of Labor, Treasury Department, Securities and Exchange Commission, and other financial agencies to collectively evaluate the risks and opportunities of digital assets. The agencies have also been tasked with using their findings to propose policies that promote a more stable and secure market for consumers, investors, and businesses.

Many experts view the executive order as an “unmitigated positive signal” that cryptocurrencies are here to stay, a surprising tenor from a Biden administration that had instead been expected to crack down on the nascent cryptocurrency industry. Rather, the directive has legitimized digital assets by aiming to install proper safeguards to protect current and prospective participants in the crypto boom. As a result, the price of Bitcoin jumped nearly 9% overnight in response to President Biden’s statement.

In particular, the announcement signals a meaningful victory for institutional investors hoping to share in cryptocurrencies’ upside potential. As discussed in a recent OnLabor post, public pension funds — the traditionally circumspect stewards of public-employee retirement accounts — have just begun to venture into the cryptocurrency arena. This decision was motivated by the realization that cryptocurrency offers a potentially lucrative path for pension funds to generate more profit and meet their ballooning retiree obligations, which have nearly doubled in the past 10 years. Unfortunately, the asset’s volatility and lack of regulatory protections have rendered cryptocurrencies a decidedly risky solution, with an alarming amount of fraud and theft currently miring the underdeveloped market.

Now, however, pension funds should feel more confident in their risk-reward assessment of crypto investing. Though it is too early to speculate which individual policies will come out of the forthcoming six-month study, pension funds fall squarely within the executive order’s first focus area — “consumer and investor protection” — and should expect to have their voices heard by the Department of Labor.

For additional context, operating in the background of the executive order is the concern that international jurisdictions may adopt more favorable regulatory frameworks more quickly than the United States does, thereby attracting businesses that use digital currencies and undermining American competitiveness. Recognizing the “explosive growth” of cryptocurrency trading — illustrated by the fact that even the slow-moving pension funds are wading into the space — the Biden administration has felt pressure to mitigate the dangers of today’s Wild West governance landscape and establish a safer marketplace within which consumers and investors can confidently transact.

As one insider described, this directive is merely a “starting gun” of a race, with several more cryptocurrency-related developments and guidelines expected to follow from the Biden administration. Until then, though, public pension funds must be thankful that such a race is taking place at all.

Daily News & Commentary

Start your day with our roundup of the latest labor developments. See all

February 23

In today’s news and commentary, the Trump administration proposes a rule limiting employment authorization for asylum seekers and Matt Bruenig introduces a new LLM tool analyzing employer rules under Stericycle. Law360 reports that the Trump administration proposed a rule on Friday that would change the employment authorization process for asylum seekers. Under the proposed rule, […]

February 22

A petition for certiorari in Bivens v. Zep, New York nurses end their historic six-week-strike, and Professor Block argues for just cause protections in New York City.

February 20

An analysis of the Board's decisions since regaining a quorum; 5th Circuit dissent criticizes Wright Line, Thryv.

February 19

Union membership increases slightly; Washington farmworker bill fails to make it out of committee; and unions in Argentina are on strike protesting President Milei’s labor reform bill.

February 18

A ruling against forced labor in CO prisons; business coalition lacks standing to challenge captive audience ban; labor unions to participate in rent strike in MN

February 17

San Francisco teachers’ strike ends; EEOC releases new guidance on telework; NFL must litigate discrimination and retaliation claims.