Eric Jang is a student at Harvard Law School and a member of the Labor and Employment Lab.

The Office of Labor-Management Standard’s (OLMS) positions on union financial reporting and disclosure requirements resemble a pendulum, swinging back and forth in tune with the duopolistic nature of US elections. By facilitating a political battle between Democrats and Republicans over union financial reporting rules, the Labor-Management Reporting and Disclosure Act (LMRDA) has become overly complex and inconsistent. As a result, the core purpose of union reporting is at risk: allowing union members an accurate, digestible, and timely view of their union’s finances.

Labor Union Financial Reporting

Under the LMRDA, all labor unions (with the exception of public employee unions) are required to file financial reports with the OLMS. These financial reports are publicly available on the OLMS website. Depending on the union’s total annual receipts, they file different forms: LM-4s for unions with receipts less than $10K, LM-3s for unions with receipts between $10K and $250K, and LM-2s for unions with receipts more than $250K. As unions get larger, so do reporting requirements. In fact, the LM-2 requirements are much more demanding than publicly-traded corporations.

For one, large unions are required to disclose the total “salary, allowances, and any direct and indirect disbursements” to all its officers and employees which exceed $10,000 in a fiscal year. This would include everyone from the union’s president to its janitorial staff. In contrast, publicly-traded corporations are required only to disclose the compensation of its top-level executives and board members.

Another example is that large unions must provide details of all its transactions greater than $5,000 by identifying the counterparty and purpose. Meanwhile, corporations have no such obligation to disclose the source or purpose of the money coming in and out of their bank accounts. They could even lump together over a billion dollars of revenues as “Other Income” without so much as a sentence explaining its origins.

And the list goes on. As a result of additional requirements imposed upon labor unions, the union financial reporting regime can be impossibly difficult for accountants to navigate. In such a complex reporting environment, a SALY approach by the OLMS would make a meaningful difference in helping unions make correct financial reporting decisions and improve transparency for union members.

Who’s SALY?

Among accountants, SALY is a wise and well-respected mentor. It is an acronym for “Same As Last Year”, and it is an unspoken doctrine that accounting treatments and methods should be copied from the previous year. To an extent, SALY reflects an attitude to avoid making changes in one’s work. However, SALY remains an effective mentor because accounting issues are rarely novel, and it upholds a crucially important accounting principle: consistency.

Consistency is important to accountants for two reasons. First, maintaining consistent methods of accounting means you can compare your current year performance with your previous year’s financial statements. Imagine if a baker were to decide that the ovens she purchased during the current year should be treated as an expense instead of fixed assets. As a result of her accounting rule change, the bakery’s financial statements would show that her expenses have increased by the cost of the ovens, so her business is less profitable. Yet in reality, she could have effectively earned the same amount of income as last year. By changing accounting policies, financial statements become less useful when comparing how the organization has performed over the past year.

Second, consistency is easy to apply. On the rare occasion when there are novel transactions or even minor changes to financial reporting standards, accountants have to conduct hours of research and draft accounting memos which justifies the reporting treatment to future auditors. When accounting rules are being applied for the first time, there is a significantly higher risk of misreporting. But once this work is done, adhering to SALY means you will get it right without having to do all of the extra research and writing.

SALY is an incredibly useful tool for accountants working in corporations, non-profit organizations and government agencies. However for labor unions, SALY is constantly under attack.

Politics in Union Financial Reporting

Due to political pressures, reporting standards for labor unions are under constant threat of major changes. Under Republican presidencies, the OLMS often cites concerns with union management embezzling funds and the need to protect the members’ interests to issue new reporting requirements. The T-1 form is a good example.

First proposed in 2002 under the Bush administration, the T-1 was aimed to address an increasing “number of financial failures and irregularities involving pension funds and other member accounts maintained by labor organizations”. As a remedy, large labor unions would be required to file an additional form to disclose more information about trusts owned or controlled by union management. The proposed rule faced multiple legal challenges from labor organizations and was not enacted until 2008. But in 2010 under the Obama administration, the OLMS decided that the T-1 was overly burdensome and failed to accomplish its stated purpose. Therefore, the rule was rescinded. In 2019, the T-1 made a comeback under the Trump administration, citing concerns that union management was using trusts to hide union funds. You might be able to guess what happened to the T-1 last year under President Biden. It was rescinded once again.

The T-1 is not an anomaly. In 2020, the OLMS proposed an expansion of the LM-2 to include more reporting requirements, such as a requirement to disclose its strike funds which would be devastating to unions’ negotiating power. But in March of 2021, the proposal was withdrawn.

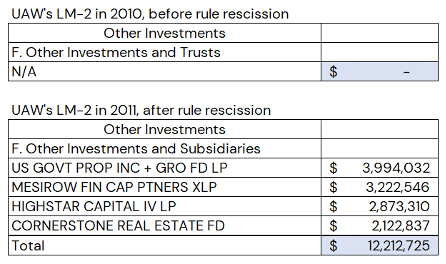

Neither the T-1 nor an expanded LM-2 has actually seen the light of day. In each instance, a change in administration quickly rescinded the rules before labor organizations had to file either form. But the process of enacting and rescinding rules has caused material changes in other ways. When the T-1 rule was first issued in 2003, the OLMS also removed the requirement to disclose union subsidiaries from the LM-2 because they would have been captured under the T-1. But when the D.C. Court of Appeals vacated the T-1 form in AFL–CIO v. Chao, the LM-2 was never restored to its original state. The gap in union subsidiary reporting was not fixed until 2010, when the OLMS rescinded the entire T-1 rule. For the 1,128 labor unions which have at least one subsidiary organization, the LM-2s in 2010 and 2011 might look like this:

An average reader who is blissfully unaware of the LM-2 debacle would assume that the UAW purchased $12.2M of other investments between 2010 and 2011: they did not. Instead, the rules changed and subsidiaries which should have been shown in 2010 are appearing in post-2011 disclosures. If UAW’s accountants followed SALY and applied the same accounting principles from 2010, the 2011 LM-2 would have run afoul of the new reporting guidelines. On the other hand, the new LM-2’s reflect a departure from previous accounting policies that can mislead union members.

Had the elections in 2008 and 2020 ended differently, the changes to union financial reporting would have been even more drastic. Such changes would make SALY an unworkable doctrine for union accountants and increase the risk for reporting violations, while also hindering the members’ ability to understand their union’s financial activities. Although both Democrats and Republicans could be pursuing legitimate political goals when changing the financial reporting rules, the endless back-and-forth comes at a cost to the public who might prefer to keep it SALY.

Daily News & Commentary

Start your day with our roundup of the latest labor developments. See all

July 9

In Today’s News and Commentary, the Supreme Court green-lights mass firings of federal workers, the Agricultural Secretary suggests Medicaid recipients can replace deported farm workers, and DHS ends Temporary Protected Status for Hondurans and Nicaraguans. In an 8-1 emergency docket decision released yesterday afternoon, the Supreme Court lifted an injunction by U.S. District Judge Susan […]

July 8

In today’s news and commentary, Apple wins at the Fifth Circuit against the NLRB, Florida enacts a noncompete-friendly law, and complications with the No Tax on Tips in the Big Beautiful Bill. Apple won an appeal overturning a National Labor Relations Board (NLRB) decision that the company violated labor law by coercively questioning an employee […]

July 7

LA economy deals with fallout from ICE raids; a new appeal challenges the NCAA antitrust settlement; and the EPA places dissenting employees on leave.

July 6

Municipal workers in Philadelphia continue to strike; Zohran Mamdani collects union endorsements; UFCW grocery workers in California and Colorado reach tentative agreements.

July 4

The DOL scraps a Biden-era proposed rule to end subminimum wages for disabled workers; millions will lose access to Medicaid and SNAP due to new proof of work requirements; and states step up in the noncompete policy space.

July 3

California compromises with unions on housing; 11th Circuit rules against transgender teacher; Harvard removes hundreds from grad student union.