Ethan Borrasso is a student at Harvard Law School and a member of the Labor and Employment Lab.

Earlier this year, Congress passed the American Rescue Plan, a stimulus package designed to facilitate recovery from the economic impact of COVID-19. Among the many benefits of the bill, one stands out: the temporary increase to the Child Tax Credit (CTC). The CTC and the Earned Income Tax Credit have been the principal tax policy assisting low-income households with children. However, the latest, albeit temporary, iteration of the CTC accomplishes much more. The most obvious benefit is the immediate reduction in the poverty rate. However, the passage of this bill represents more. The increased credit amount allows working parents to choose whether to work more or even less: parents are provided greater autonomy to determine what’s best for their family. Additionally, the advance payments of the CTC represent a considerable step in the direction of a Universal Basic Income (UBI) type system.

The Child Tax Credit

The CTC began in 1997 as part of the Taxpayer Relief Act. Initially, the credit was $400 per child and was generally nonrefundable. A year later, it was increased to $500 per child. The first significant change to the CTC came in 2001 when the credit was made refundable. A refundable tax credit creates the possibility of negative tax liability. This allows any excess credit to be returned in a refund the following year. The next significant change was ushered in by the American Taxpayer Relief Act of 2012, which increased the CTC from $500 per child to $1,000 per child.

The Tax Cuts and Jobs Act of 2017 (TCJA) temporarily increased the CTC through 2025 and raised the credit from $1,000 to $2,000 per child. Additionally, the refundable portion of the credit was limited to $1,400 per child and allowed a nonrefundable credit for qualified dependents. Unless extended by Congress, the CTC will revert to $1,000 per child, and other dependents would no longer be eligible beginning in 2026.

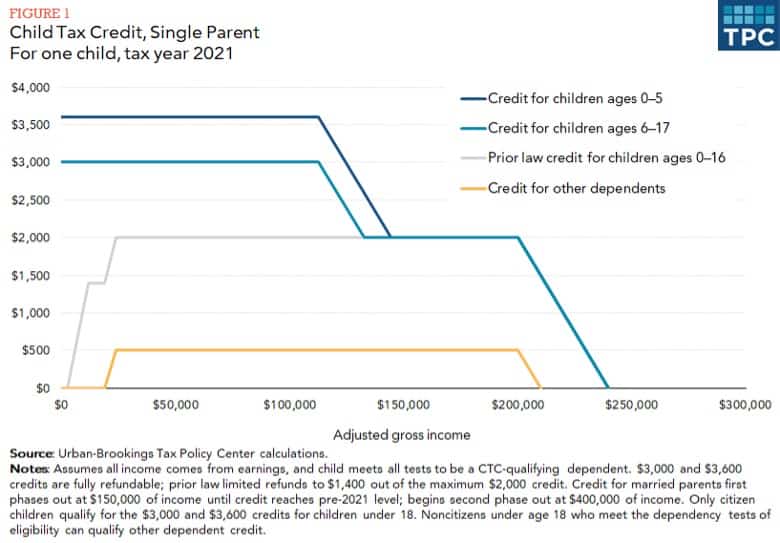

In 2021, Congress put into effect the most expansive increase to the CTC to date. In its current form, American citizens can claim up to $3,600 per child under six years old and $3,000 per child ages six to seventeen. There is no cap for families with multiple children, and the credit is fully refundable. Regardless of how much low-income families earn, they receive the maximum amount with a phaseout beginning at $112,500 for single parents and $150,000 for married couples. A visual representation from the Tax Policy Center shows the difference between the 2021 and TCJA credits.

The Underlying Benefits of the 2021 CTC

The 2021 CTC positives are obvious, but three main benefits make this update one of the most impactful changes in tax policy.

First, the cash payment structure of the credit immediately reduces child poverty. Instead of receiving the credit as a lump sum in a tax return the following year, the Internal Revenue Service provides half of the refundable credit as periodic advance payments. Families will then be able to claim the other half of the credit when they file their taxes in 2022. After the deposits began in July, a Columbia University study found that the updated CTC immediately lifted over three million children out of poverty. This reduction represents about a 40% reduction in the monthly child poverty rate. Expanding on poverty reduction further, a paper published in September found that the initial payments led to a 25% drop in food insufficiency among low-income households with children. Research shows that children who grow up in poverty face substantial hardships in education and are more likely to be charged with a felony.

Second, the 2021 CTC substantially increased the agency of working parents. According to a study released in September, 94% of parents indicated that the monthly payments would allow them to work the same amount or more. With 6% stating that they would work less or change jobs, most of whom were parents with infants or toddlers. Without any strings attached, the CTC lets parents make the best decisions for their specific situation. The payments allowed some parents to work more hours by having their childcare costs covered. Alternatively, other parents can stay home with their small children knowing they still receive a small income. The study also found that over 20% of respondents had their own business or planned to start one.

Along with flexibility in the short term, the CTC also facilitates family social mobility over time. In a survey measuring the planned usage of the CTC, most low-income families planned on using the credit to cover essential expenses for their household and children and build emergency savings. Most U.S. families already live paycheck to paycheck and are unable to afford an unexpected $500 bill. These limitations make it almost impossible to manage and build even modest savings successfully. The periodic CTC payments give these families more room to meet their essential needs while investing in their children’s future. Over a long enough period, the CTC payments elevate low-income families and offer them the agency to build for the future.

Finally, the 2021 CTC could act as a stepping stone to a more permanent system of cash payments to Americans: Universal Basic Income. The idea of UBI has been around for hundreds of years but has recently become more mainstream. Former presidential candidate Andrew Yang ran a moderately successful campaign by advocating for a “Freedom Dividend”: monthly recurring payments of $1,000 for every adult citizen. Just two years later, UBI has gained significant popularity and is now in the national political dialogue.

Roughly 39 million families received the advance CTC payments, making it one of the most extensive direct cash distributions in history. Congressional debate is currently ongoing whether to let the 2021 CTC expire next year or to renew it. If Congress does not extend the 2021 CTC, millions of families will go back to claiming the reduced credit when they file their taxes. However, these families often take on high-interest debt and predatory loans while waiting for their tax returns. Periodic payments greatly benefit families without an expenditure cost for the federal government.

Of course, despite the innovation of the expanded CTC, some voters disagree with making it permanent, based partly on the fact that it entails a significant government expenditure. Additionally, only families making less than $125,000 (for a single-parent household) with children are eligible for the credit. One of the main draws to UBI is its universality, and the 2021 CTC does not provide it. Despite these challenges, the new Child Tax Credit is the first step to rethinking tax policy and wealth redistribution in America. The next fight is making this expansion permanent.

Daily News & Commentary

Start your day with our roundup of the latest labor developments. See all

January 30

Multiple unions endorse a national general strike, and tech companies spend millions on ad campaigns for data centers.

January 29

Texas pauses H-1B hiring; NLRB General Counsel announces new procedures and priorities; Fourth Circuit rejects a teacher's challenge to pronoun policies.

January 28

Over 15,000 New York City nurses continue to strike with support from Mayor Mamdani; a judge grants a preliminary injunction that prevents DHS from ending family reunification parole programs for thousands of family members of U.S. citizens and green-card holders; and decisions in SDNY address whether employees may receive accommodations for telework due to potential exposure to COVID-19 when essential functions cannot be completed at home.

January 27

NYC's new delivery-app tipping law takes effect; 31,000 Kaiser Permanente nurses and healthcare workers go on strike; the NJ Appellate Division revives Atlantic City casino workers’ lawsuit challenging the state’s casino smoking exemption.

January 26

Unions mourn Alex Pretti, EEOC concentrates power, courts decide reach of EFAA.

January 25

Uber and Lyft face class actions against “women preference” matching, Virginia home healthcare workers push for a collective bargaining bill, and the NLRB launches a new intake protocol.