Chinmay G. Pandit is the Digital Director of OnLabor and a student at Harvard Law School.

401(k) retirement matching, wellness stipends, childcare facilities, and more. In the wake of the Great Resignation, employers are assembling comprehensive benefits packages in a desperate effort to entice and retain talented employees. Now, to further differentiate themselves, some companies are attempting to address a widespread employee concern that 46 million Americans face today: student-loan debt.

Student debt is not a new issue. Americans currently owe $1.75 trillion in student loans, the second largest category of debt, behind only mortgages. As a snapshot, in 2019, the typical education-debt borrower owed roughly $25,000 (paid in $200 to $300 monthly installments). The following year, overall student debt increased by 12%.

A diverse suite of solutions has been proposed to solve the student-debt crisis, focusing primarily on the obligations of banks, universities, and governments to ameliorate high tuition costs or even unilaterally cancel the debt. But the $16 billion worth of student loans that the Biden Administration has canceled to date represents less than 1% of the nation’s total student loan amount. And though many congressional leaders are pushing to cancel student debt entirely, such proposals face an uphill battle.

Meanwhile, employers — the very entities that benefit from employees’ investments in higher education — have largely been left out of the conversation, viewed instead as mere income providers. However, with the recent advent of (a) heightened competition for talent resulting from the Great Resignation, (b) subsequent adjustments to the tax code, and (c) renewed recognition that employers derive substantial value from employees’ education expenditures, companies broadly must recognize the key role that they can and should play to tackle the United States’ bloated student-debt situation.

Employer-Sponsored Student Loan Repayment Plans

In a recent study, workers decisively ranked “student loan repayment aid” as one of the most-valued benefits that an employer could offer. A separate survey found that over 85% of employees would consider staying at a company for at least five years if the employer assisted with student-loan repayment. Despite this, fewer than one in ten companies presently features such a benefit. However, with an impending August 31 end to the pandemic-instigated moratorium on student-loan payments, some companies are suddenly recognizing the need to support the talented employees that they so desperately rely on.

Cue the introduction of employer-sponsored student-loan repayment plans (SLRPs). SLRPs provide workers with corporate contributions to help pay off student loans. These employer contributions can be consequential: on average, assistance of just $100 monthly shaves three years off an employee’s loan-repayment schedule.

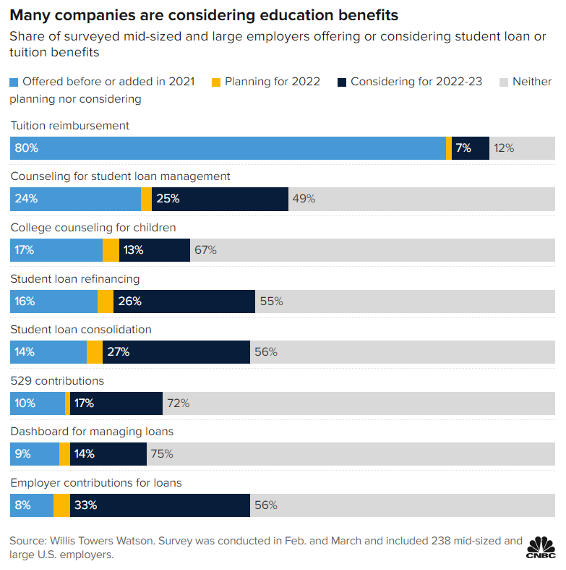

Though still uncommon, SLRPs have garnered considerable attention over the past two years, expanding by 50% since 2020; an additional 33% of companies are considering introducing SLRPs by 2023. In particular, technology, financial services, and health care companies in highly competitive markets have been the initial SLRP adopters, along with employers located in less desirable geographic regions trying to “sweeten the pot” for prospective job candidates.

For example, to combat poor retention among nurses with lucrative alternative options as travel nurses, the McLaren Hospital of Petoskey, Michigan, announced in December that it would begin offering direct student-loan assistance to employees who remain at the hospital for at least six months. The program pays $200 per month in the first year and increases by $100 per month each subsequent year, with a capped total benefit of $12,000. The program engaged nearly 200 initial participants consisting of both new hires and current staff, far surpassing the hospital’s goal of enrolling 100 employees. The hospital’s “game-chang[ing]” SLRP, according to president and CEO Chris Candela, has yielded better results than prior attempts to either enrich existing benefits or add sign-on bonuses. Notably, the SLRP contributions are provided in addition to — not instead of — established employee wages.

Similarly, citing a study showing a 78% decrease in employee turnover at companies offering SLRPs, Fidelity Investments also just announced that it would expand eligibility and increase lifetime maximum employer contributions to $15,000 for its SLRP. The program does not have any waiting period and is expected to assist 5,000 Fidelity employees, providing a powerful incentive to stick around.

Tax Benefits of the CARES Act

Though market competition has been a major driving force for certain companies to consider SLRPs, pandemic-driven changes to the tax code have made employer loan contributions even more cost effective. Under the 2020 CARES Act, employer contributions of up to $5,250 to student-loan payments are no longer counted as gross taxable income, thereby exempting the contributions from income and payroll taxes.

For context, prior to the Act, an employer contribution of $5,250 would have resulted in a net employee benefit of less than $3,700. The approximately $1,500 difference lost to taxes represents five months’ worth of debt payments (based on average monthly loan payments of $300), a severe burden for cash-strapped graduates.

Now, however, employer contributions yield a dollar-for-dollar benefit to employees, maximizing the impact of company-provided aid and instantly inspiring employers like Google to introduce their own SLRP benefits. Many experts anticipate that the employer-contribution tax-exempt status will be extended beyond its December 2025 expiration date, potentially permanently, providing the requisite policy underpinning to persuade more employers to institute SLRPs.

Employer Obligations to Employees

Renewed attention has also been drawn to the responsibility of companies to help resolve the student debt crisis, given that they depend on, and benefit from, their employees’ investments in education. Representatives at the student-focused education technology firm, Chegg, have publicly acknowledged that corporations are among the largest beneficiaries of the education and employment systems squeezing college graduates, and must therefore help “support and subsidize their employees’ education.” Chegg then launched a SLRP in 2019 entitled “Equity for Education,” paying $1 million worth of employee student debt in just two years. Additionally, new studies revealing the detrimental effects of financial stress on employees’ mental health and productivity (which has dramatically worsened since the pandemic) have further fueled calls for employers to take care of their workers via SLRPs.

Are SLRPs the Path Forward?

Among the 90% of employers that do not currently offer SLRPs, many point to concerns about treating employees inequitably by providing thousands of dollars to workers who opted to take out loans, but not to their debt-free colleagues. Other employers cite their lack of familiarity with the student-loan financial system as the primary obstacle to introducing SLRPs.

These apprehensions stem from legitimate considerations but are not insurmountable. Creative structuring of SLRPs — such as allowing employees to convert unused paid time off into student loan assistance — would promote more equitable (though maybe not perfect) optionality for employees with different financial situations. Moreover, companies like Goodly, a start-up that manages SLRP benefits for employers, provide services to help companies understand the student-debt system while streamlining the entire employer contribution process.

Of course, SLRPs should not be viewed as replacing or undermining competitive salary packages, genuine career-advancement opportunities, and positive intraoffice relationships. But in an overall effort to increase employee retention and reduce widespread financial strain (while making the most of a tax-exempt opportunity), companies must seriously consider implementing SLRPs to support their valuable workers. Because if they do, millions of employees and employers could benefit.

Daily News & Commentary

Start your day with our roundup of the latest labor developments. See all

February 27

The Ninth Circuit allows Trump to dismantle certain government unions based on national security concerns; and the DOL set to focus enforcement on firms with “outsized market power.”

February 26

Workplace AI regulations proposed in Michigan; en banc D.C. Circuit hears oral argument in CFPB case; white police officers sue Philadelphia over DEI policy.

February 25

OSHA workplace inspections significantly drop in 2025; the Court denies a petition for certiorari to review a Minnesota law banning mandatory anti-union meetings at work; and the Court declines two petitions to determine whether Air Force service members should receive backpay as a result of religious challenges to the now-revoked COVID-19 vaccine mandate.

February 24

In today’s news and commentary, the NLRB uses the Obama-era Browning-Ferris standard, a fired National Park ranger sues the Department of Interior and the National Park Service, the NLRB closes out Amazon’s labor dispute on Staten Island, and OIRA signals changes to the Biden-era independent contractor rule. The NLRB ruled that Browning-Ferris Industries jointly employed […]

February 23

In today’s news and commentary, the Trump administration proposes a rule limiting employment authorization for asylum seekers and Matt Bruenig introduces a new LLM tool analyzing employer rules under Stericycle. Law360 reports that the Trump administration proposed a rule on Friday that would change the employment authorization process for asylum seekers. Under the proposed rule, […]

February 22

A petition for certiorari in Bivens v. Zep, New York nurses end their historic six-week-strike, and Professor Block argues for just cause protections in New York City.