Sanjukta Paul’s current research and writing involves the intersection of antitrust law and labor policy, in particular how and why antitrust law has limited the coordination rights of working people. Her book project on this topic will be published as Solidarity in the Shadow of Antitrust by Cambridge University Press. She is generally interested in the intersections of work regulation and the law of business, and in how law constructs economic life. Her papers include “Uber as For-Profit Hiring Hall: A Price-Fixing Paradox and its Implications” (spring 2017), published in the Berkeley Journal of Employment & Labor Law, and “The Enduring Ambiguities of Antitrust Liability for Worker Collective Action” (spring 2016), which was recognized with the Jerry S. Cohen Memorial Fund’s award for the best antitrust scholarship of 2016 (category prize), presented by the American Antitrust Institute. She is also contributing a chapter on antitrust and workers to the forthcoming Reviving American Labor (C. Garden and R. Bales, eds., Cambridge University Press, forthcoming). Paul previously served as David J. Epstein Fellow in Public Interest Law & Policy at UCLA Law School. There she designed and taught the Workers Rights Litigation Clinic, which represented low-wage workers in wage theft claims, and in a complex class action alongside local non-profit organizations. Prior to this fellowship, Paul practiced as a public interest lawyer in Los Angeles for several years, focusing on employment and civil rights litigation, as well as some labor union matters. During this time she also worked on the campaign to reform the working conditions in the port trucking industry with the policy nonprofit Los Angeles Alliance for a New Economy. Paul clerked for the Honorable Alfred T. Goodwin of the Ninth Circuit Court of Appeals. She is a graduate of Yale Law School, where she was a Coker Fellow, and studied philosophy at the University of Pittsburgh, where she held a national Mellon Fellowship in Humanistic Studies and earned an M.A.

New York City’s new minimum payments rule for drivers in the ride-hailing sector is sorely needed, and is in many ways a policy model for cities around the country. The City ought to perfect this path-breaking policy by ensuring that it does not advantage dominant firms—currently, Uber—and handicap non-dominant firms, a result that will not benefit drivers in New York City or elsewhere in the long run.

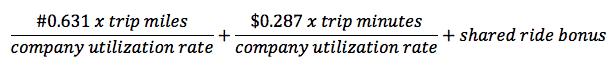

The goal of the rule is to ensure that drivers’ net pay is at least $17.22/hour. As written, the rule computes per-mile and per-minute pay rates (both components of the amounts ultimately due drivers) on the basis of each company’s “utilization rate,” which is determined “by dividing the total amount of time drivers spend transporting passengers on trips dispatched by the [firm] by the total amount of time drivers are available to accept dispatches from the [firm].” The formula for a company’s minimum payments to drivers is:

As a result, the lower a company’s utilization rate (say, .37 rather .58), the higher both its per-mile and per-minute rates are. Conversely, the higher a company’s utilization rate (.58 rather than .37), the lower both the per-mile and per-minute rates are. The purpose of this formula appears to be to effectuate a secondary goal of the policy: by encouraging firms to increase their utilization rates, the City seeks to minimize the time that drivers spend logged onto the app (and presumably on the road) but not transporting passengers.

This method, however, seems to assume that drivers are only logged onto one app at a time, which is very often not the case. The resulting problem is that the rule seems likely to advantage dominant firms over non-dominant ones. That is because the dominant firm’s utilization rate (that is, Uber’s utilization rate) is likely to be higher than others’—not as a consequence of internal firm policies regarding idle time, but simply as a consequence of market dominance. In other words, a larger number of riders currently use the Uber app than the Lyft or Juno apps; as a result of that fact alone, a driver logged onto all three apps is more likely to receive ride requests from Uber. In that scenario, Uber ends up with a more favorable utilization rate, and is required by the rule to pay a lower minimum than a firm with a low market share.

For this reason, when it was first announced in December the rule predictably led to vocal opposition from firms like Lyft and Juno. Last week, both firms filed petitions in state court challenging the Taxi & Limousine Commission’s rule as an arbitrary and capricious agency action under state law. According to Juno’s court filing, the Commission subsequently announced that it will not in fact use the utilization rate to calculate minimum payments but instead will split drivers’ idle time in such scenarios evenly among each company—although reports of last Friday’s court proceeding again suggest that the Commission will indeed go forward with the rule as written, following a one-year trial period during which each company will be charged according to Uber’s 58% utilization rate. Juno also claims that its business model is premised upon its superior driver-facing policies, in particular that it “charges drivers 60-65% lower commissions than competitors in New York City so that more money from each ride goes to the drivers, rather than to the company.”

(Worth noting is that another firm with a very small market share, Via, reportedly has the “industry’s highest utilization rate” and is not fighting the rule, saying that it is already paying drivers more than the minimum. If that’s right, a possible explanation is that Via operates in a slightly different market—only pooled rides that stop on street-corners rather than specific addresses—and that there is therefore less overlap with Uber riders. Alternatively, Via may charge drivers so much less of the ride price in comparison to Uber and Lyft that the rule really doesn’t matter to it.)

It’s important to separate what makes sense in the opposition to the new rule from what does not. Lyft, for example, stirs into its court petition tired, over-broad tropes against minimum payments as such. Such arguments against minimum payments to drivers should be categorically rejected—by the judge hearing the cases, by the City, and by all cities, for good. Economists now possess a great deal of evidence—some of it coming out of studies of Seattle’s $15 minimum wage law—that minimum wage increases do not reduce employment, and that they instead reduce turnover on the job and increase workers’ earnings. The contention that a minimum payments policy would harm drivers by causing a reduction in the total number of rides provided that outweighs the increase in payments per ride is in opposition to the evidence.

Both minimum payments and collective bargaining are mechanisms of market coordination that take into account the public’s and workers’ interests along with firms’. In the absence of such mechanisms, a dominant firm like Uber otherwise controls and regulates ride services markets itself—a position of dominance that it has sought to maintain by arguing that driver collective bargaining is an antitrust harm while its own price coordination is “efficient.” For the same reason, it isn’t a good idea to penalize non-dominant firms, particularly if they seek to compete with Uber partly on the basis of superior driver-facing policies. If indeed the rule does so, it should be amended.

One simple solution, if the City wants to preserve the secondary policy aim of reducing congestion, would be amend the rule so that when a driver is logged on to multiple apps at once, the dominant firm pays for all “idle time.” This reflects not only the dominant firm’s superior ability to pay, as well as a general public policy in favor of discouraging monopoly, but also the fact that such a firm is gaining the most economic benefit from the driver’s idle time and should therefore be the one to compensate him or her for it.

Daily News & Commentary

Start your day with our roundup of the latest labor developments. See all

December 11

In today’s News and Commentary, Biden’s NLRB pick heads to Senate vote, DOL settles a farmworker lawsuit, and a federal judge blocks Albertsons-Kroger merger. Democrats have moved to expedite re-confirmation proceedings for NLRB Chair Lauren McFerran, which would grant her another five years on the Board. If the Democrats succeed in finding 50 Senate votes […]

December 10

In today’s News and Commentary, advocacy groups lay out demands for Lori Chavez-DeRemer at DOL, a German union leader calls for ending the country’s debt brake, Teamsters give Amazon a deadline to agree to bargaining dates, and graduates of coding bootcamps face a labor market reshaped by the rise of AI. Worker advocacy groups have […]

December 9

Teamsters file charges against Costco; a sanitation contractor is fined child labor law violations, and workers give VW an ultimatum ahead of the latest negotiation attempts

December 8

Massachusetts rideshare drivers prepare to unionize; Starbucks and Nestlé supply chains use child labor, report says.

December 6

In today’s news and commentary, DOL attempts to abolish subminimum wage for workers with disabilities, AFGE reaches remote work agreement with SSA, and George Washington University resident doctors vote to strike. This week, the Department of Labor proposed a rule to abolish the Fair Labor Standards Act’s Section 14(c) program, which allows employers to pay […]

December 4

South Korea’s largest labor union began a general strike calling for the President’s removal, a Wisconsin judge reinstated bargaining rights for the state’s public sector workers, and the NLRB issued another ruling against Starbucks for anti-union practices.